Nowadays being a driver is not only a great pleasure or relax; it is also the nightmares of every ordinary motorist. Just imagine millions and billions of threads – real and imaginary – he thinks of!

In fact the major part of these problems can be addressed to an insurance company. Certainly, you have to care about liability car insurance beforehand.

What is Liability Car Insurance? Tips for Newcomers

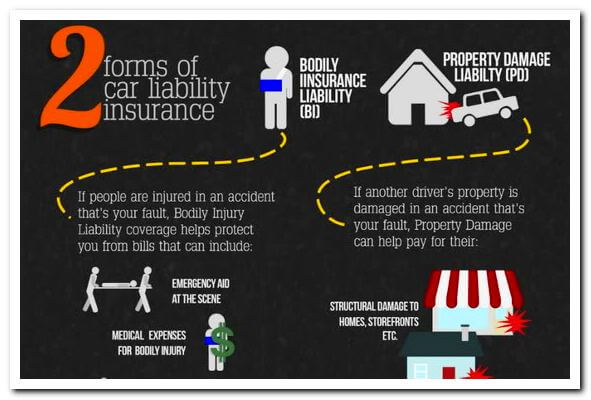

Liability car insurance definition can be given in simple words. It is the guarantee of your paying ability to the other motorists, if you suddenly will have an idea to break their cars. Of course, you won’t do it purposely, but if you provoke car crash, this very moment you will owe money to the owner of the other car for his vehicle, pain and suffer. The insurance company, where you have a policy and made premiums during a certain period before, is the proof that you can compensate the losses of another driver if you hurt him or his car in an accident. According to this policy, only the expanses of the third party are covered – remember it! Your losses remain your own headache.

Liability car insurance definition you can find everywhere online or explain in your own words. In any case it won’t change its basic idea – it is responsibility. No one can guarantee that he will never become the reason of an accident. We have plenty of reasons to be inattentive – personal problems, insomnia or troubles with our children – any of these situations is enough to forget about road rules. We are responsible, but we have no money – sad and widespread event in everybody’s life. It is normal, that if you buy a car, you make some contribution in the safety of another person. The driver of the third party car is not guilty in your personal problems. You must be sure that you will pay him in case of a car crash – it is the least that you can do, if you are reasponsible for an accident. The question “what is liability car insurance” is important in every state, except New Hampshire. On the territory of this state making this deal is desirable but not compulsory. In all the other states purchasing car liability insurance is a must-have.

Of course, car liability insurance makes you and the other drivers if not safe, then at least paid. Car crash is a mishap and at least some certain amount of coverage can help us to cope with it. The guilty driver had even to get the credit in his bank to pay for his crashed car. That’s why many motorists prefer to get another component of car insurance – collision car insurance, for example, or any other to cover his losses too, although it is not compulsory.

Cheap Liability Car Insurance – Tips for Austerity Budget

One more nightmare of an ordinary motorist is liability car insurance cost. You have to pay a lot for your car – petrol and repairing – and if monthly premiums for the vehicle are added on a regular basis, it becomes really catastrophic for the budget of many car owners. So, getting cheap liability car insurance seems so attractive to people, who don’t earn too much. Before we will discuss this topic, let’s pay attention to the following facts.

- In many states there’s some minimal amount that must be paid to the participants of an accident. It is determined by the law. Thus the cheapest policy is in Florida. There the coverage is $10,000 for an injured person. The same amount is required to repair the vehicle. In many other states this minimal level of coverage is higher. So try to learn in advance, what coverage is required in your state. It is the cheapest level you can count on.

- Remember, that insurance policy must be not only cheap. It also must help you in the minute of trouble. You dream to get minimal premiums, but you will get a solid problem in future, when receive extremely low compensation. So try to find the necessary balance between cheap liability car insurance and the amount of liability car insurance coverage.

Very often cheap liability car insurance presumes the minimal amount of coverage that is allowed in your state. In fact very often this amount is not enough, if the car of the other participant of the accident will be too expensive or he or she will be seriously hurt in the accident. A certain sum of money will be taken from your savings. It is called franchise. Think in advance, if you are ready to pay and how much exactly you can pay.

Liability Car Insurance Coverage – Let’s Figure It out!

So, take a pen and a calculator and let’s figure it out. Liability car insurance will cost you from $500 to $2000 per year. You can make it cheaper if you want, but the “cheapest” limit is determined by the legislation in your state. It is more probable to get cheap liability car insurance for the owners of small inexpensive cars. It is fair, that rich owners of new sport cars must pay more to protect the other people on the road. If you have enough money for a great car – you should take the higher level of responsibility than an old man in an old Ford.

To calculate the average amount of coverage you need for avoiding payments from your own pocket, you have to estimate your car. How much exactly you will get for your vehicle if tomorrow you will try to sell it? This very amount is the coverage you have to count on. Then the next component of your coverage is the amount that you have to pay to the third party of the accident (for damage of his vehicle and injuries). Try to imagine the average amount for an ordinary motorist with an average car. Later you have to add some amount you will need personally for your recovery if you have wounds too. Add these three components and you will get an average amount of coverage you will need.

Even if this amount seems too expensive for you, don’t refuse from signing up this contract. In fact even two thousand dollars per year is not so great sum, if you divide it and pay some premiums monthly. But if once you will be the participant of a car crash, you will feel much better if everything will be covered.

Very often, even if we have money, we saved them for some purpose. We always have some plan, where we must spend our money, so if some unexpected expanses take place, we feel disappointed. Liability car insurance policy is the guarantee of protection and you shouldn’t save money on it. It is the payment for the peace and trust in your soul.

To sum up, liability car insurance is a must have for a car owner. Thus you show that you can pay for the car of another person if somehow you break it. In every state this insurance deal is mandatory (except New Hampshire) and some minimal rate you must pay is determined. It is desirable for any driver to get some additional coverage to this rate.