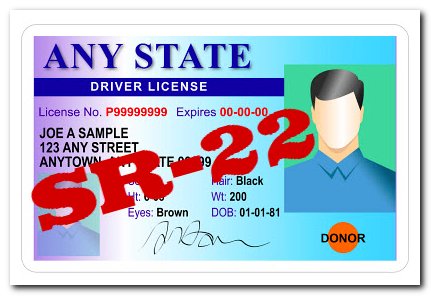

Many people call SR-22 “specific category of car policy”. But is not car policy, it is certificate – other type of document.

After my first years of education, I got my first detention. I still remember that feeling of horror and anxiety, when I was waiting for my parents’ reaction. It was a wonder for me, but they didn’t get mad and didn’t punish meat all. Just several extra hours at school – nothing more and I was so nervous!

Only a few things in life are worth our worrying, all the others are temporary. And like that detention, your SR-22 doesn’t weigh too much. Let’s discuss, what will happen to you, if you have to file one!

Specific Category of Car Policy

Many people call SR-22 “specific category of car policy”. But is not car policy, it is certificate – other type of document. Thus your insurer vouches for you! This document is given to a driver, if his auto insurance was suspended because of some certain reasons. Most of Americans are afraid to hear the phrase from a traffic cop that “I ask you to file SR-22” as they consider it as a penalty. Actually, it is not, it is the proof of your financial responsibility. Nevertheless, this form is the sign of your negligence on the road. Drivers, who had several beers before doing on the road, those, who have invalid car insurance or don’t have it at all, can be forced to file.

Keep in mind, that SR-22 and car insurance are not mutually exclusive. SR-22 file is the secondary coverage, which is supposed for high risky drivers. It is added to the general policy of auto insurance and it doesn’t work as a separate product.

Why are we forced to get SR-22? It is the evidence of the financial responsibility of the driver. If you have paid for this insurance certificate, you will pay too, if you cause car crash and cover the damage to another vehicle. Car accident will cost you a lot – that’s why you will try to avoid it – it is iron logic, with the help of which thousands of drivers become more conscious and attentive while making their trips.

How to get SR-22? You insurance company will send this file to you – if it can as not every company has a juridical right to file this document.

Can I get SR-22 instead of insurance policy? No, you don’t. It is the addition to your policy – that’s it. Sr-22 and car insurance must be put in one file and stored till SR-22 becomes invalid.

SR-22 is filed electronically and the copy is given to you. After that you need to have this copy all the time, as it can be checked by the policemen. The document is also stored in electronic form, so it is possible to check it even without your assistance.

The main aim of getting SR-22 is to prove your financial responsibility in case of an emergency. If you are a risky driver, you need to show that you have coverage in case of car accident.

“I don’t have a car, so I won’t get additional certificate to my car insurance” – you are wrong, if you think so. Non owner SR-22 exists for this very occasion.

This file will be stored electronically for at least three years and if you get your own vehicle during this period, SR-22 will be added to your car insurance policy. It will influence the rate!

Yes, it will cost you more than general liability insurance – but it is the way to show, that you are a responsible driver, so be ready to pay! But there’s good news – it is not too pricy!

It is not too Pricy!

In fact the price of SR-22 is not the same in different states. In some states it is just as the minimal liability insurance cost; in some others the rates are much higher.

Here are the tips for you, if you were mandated to file SR-22.

- The fee for SR-22 is about $25 (the amount is different for every state). This fee is not so high, isn’t it? You will pay it temporarily, as SR-22 is not forever.

-

Here’s the bad news. Your rate for liability auto insurance for sure will be increased. Sr-22 is usually mandatory for drivers, who have violated traffic rules, so your driving history becomes not so clear. It gives your insurance company the right to consider you as a high risky driver, so don’t be offended, that the rates of your auto insurance will be increased.

- For those, who drove without car insurance and were obliged to get SR-22, first of all getting a general policy is a great demand and then they will add SR-22 to it. The quotes will be pretty higher!

-

In some states you may be obliged paying the full auto insurance policy in one time, if you get SR-22. In this case you show your financial responsibility.

So, SR-22 is not extremely expensive. It doesn’t have a certain set of premiums – and the rates are calculated as usual, according to the model of your car and age of your car. You are considered as high risky driver in this case.

If you were impressed by the fees of SR-22, keep your head up! As this form doesn’t have the lasting effect!

Expiry Date

As usual, SR-22 is given for three years. Again, the expiry date may be different, according to the state of your residence. Three years of SR-22 are supposed for such violation as suspended insurance, the driving without insurance, accumulating of too many traffic violations within a short period of time, causing too serious collision etc.

Who gets this certificate for five years? Those, who were drunk while driving (or intoxicated in some other way). Sometimes SR-22 is taken for a long period of time after reinstating of the driving license (usually it is demanded in case of some serious road offence).

If the expiry date of your SR-22 has come, it is the time to call your auto insurer and ask him to remove the file from your car insurance. SR-22 will be completely deleted from your documents and that’s why the violation, that caused your filing SR-22, will also be cleared from your driving license.

Moving to Another State

Pay attention, that rules as for filing SR-22 and its fee are different in various states of the US. So if you plan to change your state, you need to discuss this problem with your auto insurer. If SR-22 is the same in the other state, you simply continue your payments. If the fees are higher, you will be obliged to calculate the new fess and pay them. If there’s no SR-22 in that state, you have to call to Department of Motor Vehicles and ask them for advice. You still will have SR-22 as an addition of your auto insurance and then, when it becomes invalid, you will get the right for cancellation.

Final Word

SR-22 and vehicle insurance are not equal; it cannot be taken instead of it, it is just the additional file to it. SR-22 is the kind of punishment and it will make your premiums for liability auto insurance rise, although after its expiry date it will be completely cleared from your driving history!

To sum up, SR-22 is like that detention at school – it really hurts at first and you are afraid that you have spoiled the whole life, at least your reputation, forever. And just like that school detention, it has no lasting effect and one day you will laugh, when tell about it to your friends’ company. “Once upon a time…” – any of us has hundreds of similar stories!