Do you pay loan for the car? So, gap insurance policy is a pretty good idea for you

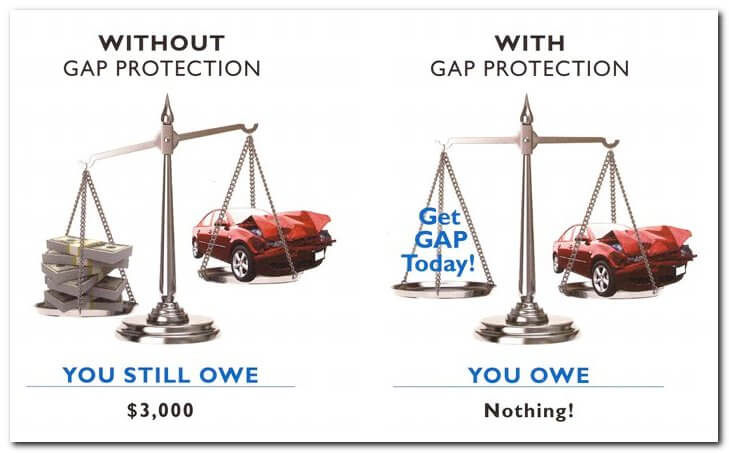

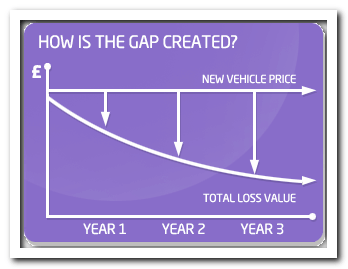

Gap insurance, or gap protection, is taken together with the general auto insurance as an addition. Often it is a useful thing for car owners, who still pay premiums for their cars (car credit). Of course, the debt that you must pay becomes a hard burden, if you take part in a car crash and have completely destroyed your iron friend. In this case, after claiming for a coverage from an insurance company, your car will be valued– and it may cost much lower than its initial price (of course, the car costs much less, than when it was new). You will get some money as a coverage, but the loan that you will be demanded to pay, will remain as high as it was from the very beginning. So gap protection is the coverage for that difference – the actual price of the car and the amount you owe for it. One good turn deserves another – so get the gap insurance to make your car dealer sleep well at night and not to worry that you will go bust and won’t pay back to him!

Explanation

Do you pay loan for the car? So, gap insurance policy is a pretty good idea for you. The active usage of the vehicle makes its price decreasing very quickly! But the loan is counted from the former price of the car, when it wasn’t in use yet. Thus your insurance company estimates the car, being based on its market value. And you pay your loan, being based on its former value. The difference – gap – between both prices is covered by gap protection.

Gap protection is a good choice for any driver, if he still pays the credit bills for his vehicle. Very often the driver fells into despair. He must pay the whole amount of loan and at the same time the insurance company gives so small coverage. It is fair, because the price of the vehicle becomes lower all the time! But not pleasant, so the gap protection is the way out of despair – it will cover the difference!

Coverage

Coverage is the highlight point of any deal. What will I receive? In fact you will be covered the difference in the initial price of your car, that normally decreases when you use it, and the market price of it nowadays.

Let’s imagine such a situation to understand this topic more clearly. You have bought your new great car for $40,000 and then it has been in use during two years. After this period accidentally you have lost your car – it was stolen or totally destroyed in an accident. Your car will be estimated by the insurer for $35,000 as it was in usage and lost thousands on its price, of course. Then you will give $500 (approximately) for deductible. So you will get the coverage of $34,500 and still owe the car dealer company or your bank $40,000. This difference – $5, 500 – will be covered by gap protection.

If you are eager to sign the policy, wait a minute –as not everything can be covered by gap insurance!

Here’s some rain on your parade!

Widespread Situations, when You Won’t Be Paid!

Very often getting gap protection is demanded by the car dealer. Thus they can be sure, that you will be able to return your debt. But if you are not obliged to buy gap insurance policy and it is the question of your own choice, keep in mind, that you won’t get the coverage in the following situations:

- Your rent will remain your problem – it is not paid by the insurance company.

- If you become disabled or lose your job, you won’t be paid.

- Your vehicle won’t be replaced by another one in case of total damage or theft.

Gap protection is a good deal, but it won’t solve all the problems you can get in case of total destroy or loss of the car. So learn the rules of gap protection to be sure that you avoid misconceptions.

Gap Insurance from Car Dealers

Car dealers often insist on getting gap insurance policy, if you purchase the car from them and still pay credit bills for it. Very often they are ready to sell this policy by themselves. Is it profitable to make the deal of this kind?

In fact, if your car dealer will tell you about great product – gap insurance – and offer to buy it immediately – it is better for you to run out from him just now!

The price for this policy will be not even twice, but thrice more of it, if you take this policy from your regular insurance agent.

The commission on gap insurance, which is taken by car dealer companies, is so great, that it becomes theft much more than deal.

The other reason, why you should avoid getting gap insurance policies from car dealer companies is the lack of professional skills. Car dealer is not an insurance agent. There are a lot of misunderstandings, when the gap protection policy is taken from car dealer and when the insurance event occurs, you can be really disappointed. Your regular agent will tell you all the details of the deal and you will have enough time to think it over and decide, whether you need it or not.

So if you are declined to buy gap insurance, tell a big “Thank you!” to your car dealer, send him a huge basket with presents and call your insurance agent after that to discuss the deal.

Making the Best Deal – Getting Gap Protection

We have already insisted that buying the policy from car dealer will cost you 50% more than if you get it directly from an insurance agent.

You should be aware that gap protections walks in one hand with the general auto insurance. You can’t get it as a separate unique product, just as the addition. So first of all you need to find an independent insurance agent and ask him, what he can propose to you.

Of course, he has to study your car insurance policy and count, what amount of coverage is supposed by it. Then he can help you to value your car – to appreciate its actual cost – and to calculate the difference. Being based on this calculation, he will offer the deal for you.

As usual gap insurance policy is not expensive and will cost you just $20-$30 per year.

Gap protection can be bought by the owner of any car, but it makes more sense to get it, if the car is new. The new vehicle loses its price extremely fast and that’s why gap protection is of great importance. If the vehicle is old, the difference between its actual price and the amount you owe for it won’t be so huge.

To sum up, gap insurance is a good product, which is worth your money. But the customers are wrong, when they expect too much from this policy. So study it properly, before you sign a contract!