Grim Hamlet with his “to be or not to be” seems a small chubby boy with toys in comparison with a modern 40-year old man, who thinks about getting long term care insurance with his “to buy or not to buy”.

Frankly speaking, this decision is really a hard one and we can’t joke, when think about our future, about our old years and preparations that must be made.

Of course we have saved some funds and need to make an investment. If we do it reasonably, we won’t make our children care about us. Our investment will provide us for this care. Otherwise we will be defenseless when we meet infirmity.

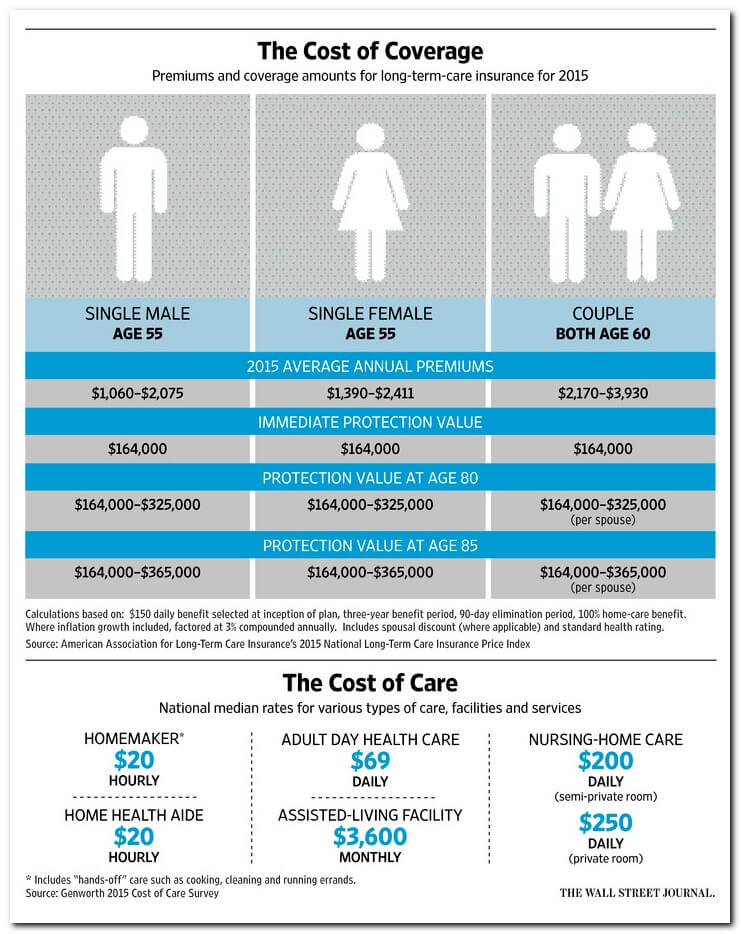

Long term care insurance seems that very thing we have looked for. Long term care facilities impress us by their variety. Nevertheless more and more people from year to year refuse from getting this kind of policy. They explain this step by too high premiums and too low level of coverage they get as a result. So let’s look into the root and make a short investigation.

Three Aspects of Advantages

Insurance companies encourage us to pay policies till we are young. It makes some sense, because the younger we are, the less risky we can be to the insurance company. Later we spend long months to apply for the thing we must have – coverage. But sometimes we don’t get it. So is this insurance worth buying?

In fact, the experts tell, that the answer is “yes”. If you buy long term care insurance, you be faced to three aspects of advantages – security, economical and psychological.

- Security aspect. Provide yourself with necessary care for your old age. Even if you have some savings (usually every person has at least $25,000 at his account), they won’t be on purpose for you, if you are disabled. When you are old, you don’t need the cash – you need help. You need care. You need a person, who will solve everyday problems, which occur in the life of any old man or woman. You can tell that it is possible to hire a nurse without the insurance company if you have enough savings. In fact, it is. I accept this argument, but it is not enough for me. When you are old and your mental activity is not so fast, every fraud can deceive you. Insurance companies deal with certified specialists. They check the portfolio of the person and the level of his professionalism.

It is easy to understand. The insurance company is ready to struggle for its reputation. If they deal with unprofessional caregivers, they will lose clients. That’s why they do this job instead of you – the check up, if the caregiver they have sent to you makes his duties well enough.

- Economical aspect. The second group of advantages that you get is economical. If you get the policy, when you are 40 or so, you will pay about $2,800 per year. Later, when you are considered as disabled, you will get about $6,000 per month. This amount is quite big and it is compared with a salary that you get nowadays, am I right? So, you lifestyle won’t be changed and your children won’t be obliged to spend their money to care about you.

- Psychological aspect. The last group of advantages that you get, if you have bought affordable long term care insurance, is psychological. I meet some elderly people, who are too weak to care about themselves. Of course, they have some savings and children, who care about them. But still the people, who are disable, stay constantly in bad mood. It is so unpleasant, when your children see you weak and helpless. When they spend their money on you. When they consider you as a burden. Of course, they will never tell these evil words to you and they will convince you that they are happy to help. But at the bottom of the heart old disable people dream to die faster, just to make their children free. But if you know, that you have taken care about yourself and forwarded the duties to assist you to representatives of your insurance company, you will feel much better and self confident, even if you have become disable.

I know, what next question you will ask from me. Why do so many people refuse from getting this policy if it is worth it?

In fact many people are not satisfied with the deal they make because they don’t study its details carefully.

Two Things to Look at Before You Make the Deal

- Read the conditions of your deal carefully. What coverage do you expect?

Many clients focus on the idea to get affordable long term care insurance. They pay attention to annual payments. But they forget to count the coverage. Very often low rates are explained by the low level of coverage you will get at the end. When your rate becomes lower, you refuse from some options. Of course, you shouldn’t buy the services that you don’t need. But be very attentive and don’t refuse from the things that are really on purpose.

Thus very often your monthly or annual rate is lower, if the period of approval is longer. Often you have to wait for the approval of your rate during 60-90 days. Are you ready to pay less, but to wait one extra month for your coverage?

- Do you have enough information to make the deal? Compare long term care insurance!

You may be so eager to buy long term care insurance, that you make the bargain just with the first company you apply. It is better to compare long term care insurance. Toyota Company will tell you that Toyota cars are the best. Ford Company will tell you the same about Ford cars. To learn, what is better for you, you have to ride the car yourself. The same thing you have to do with insurance plans. Study them yourself and compare.

- Define exactly for yourself, what long term care facilities are important for you.

Every insurance company will offer you plenty of facilities. You can apply for post hospital care, medication administration, everyday help and assistance, diabetic care, nursing home etc. Of course, you can get too many facilities or to forget to include the most necessary ones in order to save the funds.

How to choose the facilities? First of all include in your list the most necessary ones like cooking, nursing home and everyday help. For sure, you will need it in case of disability.

Then include the necessary option if you were operated or have any kind of chronic disease.

And finally, ask your agent, if it is possible to change the facilities after you have signed the contract. As this kind of deal is signed for years, situation may change and you will need some kind of help, which you can’t predict now.

So, is long term care insurance worth buying? Yes, it is worth it. But you should make the calculations correctly and define the range of services you suppose to get. Besides you have to find the service provider who is reliable enough and satisfies you needs and your nature. Otherwise it is not!