In real life the principle “the more we pay, the more we get” doesn’t presume smooth functioning. Collision insurance, or COLL, is another deal that we must make. Or mustn’t we? Let’s think!

Plenty of insurance proposes for paying customers make them lost among. Thus we are getting multiple policies for any kind of property we have and try to get slight discounts for it and hope that one rainy day we will get the full coverage for everything!

But in real life the principle “the more we pay, the more we get” doesn’t presume smooth functioning. Collision insurance, or COLL, is another deal that we must make. Or mustn’t we? Let’s think!

General Notion

So, what is COLL? It is the document that guarantees you payments from your insurance company in case of you have clash with some other car, any other kind of transport or static object. And it is not important, if the accident was possible because of your negligence, the negligence of some other driver or under unexpected circumstances.

In What Situations COLL Can Help me?

To be precise, let’s enumerate the situations, when COLL is on purpose.

- You can get the coverage in case of your own car was damaged and its value was impaired because of it. You can get the compensation even if the accident took place because of you.

- You can get another car instead of damaged one, according to this policy, if it was completely destroyed and lost its normal function. Even if you are responsible for the crash, still you can claim for car reimbursement.

- If the owner of the other vehicle is not cautious and causes the accident, where your car was damaged or destroyed, he has to pay for the repair. But in case he is uninsured and that’s why is too slow in his intention to pay you. And you are in a hurry and need the repair immediately – so you can claim for the coverage from your insurance company, if you have COLL, and you will be paid for it.

Be cautious to use this option, as your rates can be increased by the insurer after that.

- You can apply for payments from your insurer, after the harm that was done to your vehicle by a tree or by someone’s ill-will. These situations are usually covered by other insurance policies, but if they aren’t, collision insurance will be on purpose to solve these problems.

- All kinds of hit-and-run accidents must be totally covered by COLL.

Yes, I know, you have read it and now you dream to purchase collision insurance. But don’t say that this deal is the most profitable in your life till you know, what deductible is supposed here.

What is to Be Deducted?

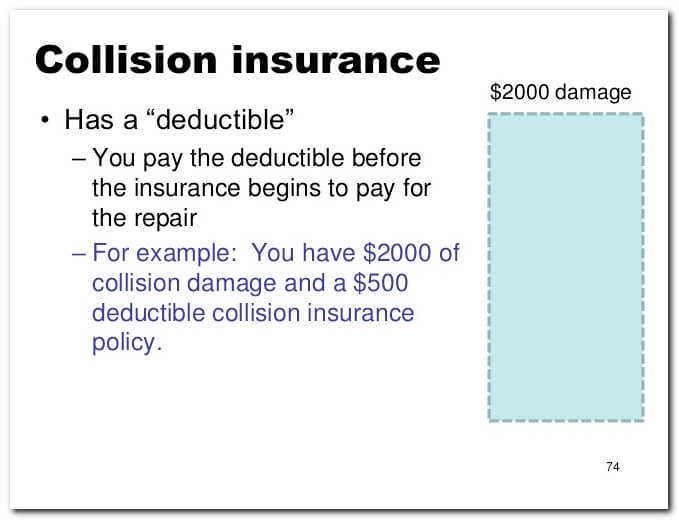

Every insurance company offers some certain amount of deductible – the amount that is paid by the insured person, when he writes a claim. As you see, the more claims you make, the more you pay, so it is much better if the amount of the deductible is as low as possible.

But don’t be too fast and don’t choose the smallest deductible while making your deal. Because the less amount of deductible you choose, the higher amount of premiums you will get.

Collision insurance presupposes deductible from $150 to $2000 – the amount varies according to the state of your residence and to the general rules that are chosen by the insurance company. As usual, the amount of deductible is chosen by the drivers between $200 – $1500.

While getting collision auto insurance policy, pay attention to this point. Deductible is very important, because it can make your deal completely of no profit.

Imagine this situation. Your car market price is $2000. It was totally destroyed in the accident. You claim for the coverage from your insurance company. Collision coverage has no special limit. But insurer won’t pay you more than the actual price of your vehicle. So you will get not more than $2000 minus deductible. If your deductible is $1000, the deal makes no use to you. So pick up the deducting amount carefully!

So, after calculating, what is supposed to be deducted, we can expect to get coverage. Usually it is the most interesting point to the customer – as collision coverage is that very sum you are going to get if the insured event will happen.

Diapason of Coverage

As the main idea of collision coverage is to fix the damaged vehicle or to reimburse it in case of clash, then the highest amount of coverage you can expect is the fair price of your car (real price at the market, as if you sell it today) minus deductible. So, as you see, the price of your car is the limit in this insurance. Diapason of protection in every state varies. It also is connected with the car you have bought and with your driving habits.

Should I Drop my Collision Insurance?

Every car owner has to think over this decision. Of course, you have a number of advantages in case if you are in an accident – and any of drivers appears in this situation at least once in his life. On the other hand, sometimes it is better to pay for car repair from your own pocket once, than all the time make payments to your insurance company. So, what will be better – to continue payments or to drop COLL? To answer this question you have to make necessary calculations and then decide.

-

You need collision coverage, if the car you own is an expensive new model. If its cost is $5000 or more – then COLL is a great investment for you.

If the price of your vehicle is $1000, it is better to repair it by your cost in case of necessity or even to buy a new one, if it becomes totally wrecked.

- Consider the idea of dropping collision insurance, if you have been using your car for about 2-3 years.

When your vehicle was new, you have purchased collision insurance policy to protect it. Then its price was $10,000 and you have paid premiums to get the whole coverage. But in two years of usage it costs maximum $5000. So you can drop your COLL this very moment or ask your insurer for the reduction of rates.

But you shouldn’t save some extra dollars and drop your policy, if you live in the area, where the possibility of car accident is high enough. Thus, if you have hills, mountains nearby or tornadoes often take place there, invest in COLL policy – you will never regret you have done it!

Summing up

So, as any other insurance, collision car insurance has its pros and cons. Consider them properly in order not to overpay. But you should prefer to be careful, than to be thrifty.