We don’t believe in God, till we appear in the car accident. We don’t appreciate our health, till we get seriously ill. Later, if we get some severe disease, we start appreciating life and purchasing an insurance policy seems a good idea for us.

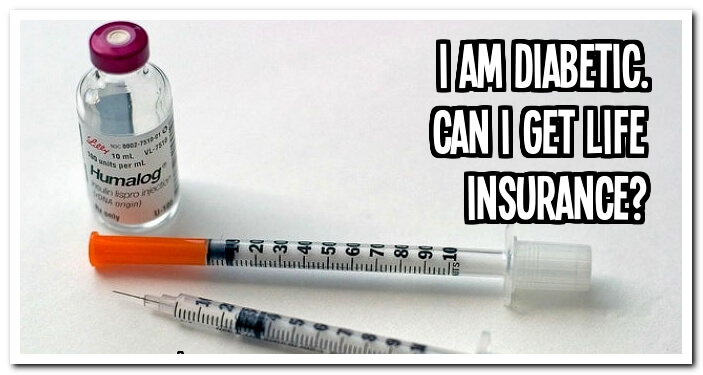

But this very moment we usually meet an obstacle – we are denied by insurance companies because of the health condition. It happens if you have diabetes too. Statistics says that about 9% of population of USA has diabetes (men, women and even children). This category of citizens needs insurance policy much more than those, who are healthy. Paradox is that they are much more frequently rejected. So is it possible to get life insurance with diabetes? And what steps to make to get the lower rates?

Getting Life Insurance with Diabetes – The Solution

Getting affordable life insurance for diabetics is not just possible; it is a right of every human being, even if he or she has diabetes. You can apply for protection and you must get it. But you should be ready for a fight. And here’s our informational support for you.

First of all you have to learn several important facts, before you take the phone and make the necessary phone call to the insurance agent. He will ask you the number of questions. Try to prepare the answers to them.

For sure, an insurance agent will ask from you, when you were diagnosed diabetes. If you suffer from diabetes since childhood and the period you are ill is long enough, the rates for your life insurance will be higher or even you can be denied.

Then you will tell about the type of diabetes you have. 95% of those, who have diabetes, suffer from the second type. This type is much more controlled. It is more treatable and the positive reaction of patients to diet and treatment is much more noticeable. Besides a lot of good can do exercises and insulin injections. So if you have this type of diabetes, you can purchase affordable life insurance for diabetics.

Then your agent will ask you about the general health condition. Very often diabetes leads to different complications. So if you have just diabetes – and that’s all – you can get your inexpensive policy.

Of course, you should be non-smoker to get the policy. Smoking is harmful for anybody, but it is really dangerous for people with diabetes. Thus you will be too risky for insurers and they will increase the rates up to heaven.

Finally your agent will ask you about the medical history of your family. Do you have other relatives, who suffer from diabetes? Do you have any relatives, who died from diabetes? What age did they die?

Later you will pass some medical tests (blood and urine) and after that you will be referred to one of 4 health groups.

All the people, who apply for life insurance, are divided by the insurance companies into four groups. According to the group you belong, you receive different levels of rates. Thus clients are divided into such categories: preferred plus (the healthiest), preferred (with normal health, above average), standard (average), substandard (with some chronic disease).

It is possible for people with diabetes of the second type to be referred to standard group, where the rates are much lower than substandard.

To become the member of this group, a person must care about the health, have no bad habits and lead healthy lifestyle. In this case even diabetes of the second type can’t prevent this person from getting lower rates.

After medical tests and group division, your agent will offer you to make one of two kinds of deals. You can buy term life insurance for diabetics or whole life insurance for diabetics.

Term Life Insurance for Diabetes

This type of insurance is advised to the client with diabetes by the agents frequently. Of course, if you are young enough, even if you have diabetes, you for sure will live more than 10 years (this is the minimal limit of term life insurance). It is not the highest risk for the insurance company and for sure they will offer you lower rates.

But what to do, if you dream about whole life insurance policy?

Even if you have diabetes since childhood, you can get whole life insurance. Everyone has a right for protection and that is not fair that people with some chronic disease are denied. So even if you were rejected earlier, don’t leave your hope to buy whole life insurance for diabetics.

At first you have to pass all medical tests and send this information to many various insurance companies. Compare the rates – the companies are different. Some of them are really strict to health condition and the others are loyal and can offer you affordable variant of contract.

Then get rid of different bad habits and make your lifestyle as healthy as possible. You can’t even pretend, what great influence has the healthy way of life on every person. People with the most severe chronic illnesses like tuberculosis or cancer live much more, when they take care about themselves. Don’t forget to inform your agent about every positive impact that you notice in your health condition. For sure, he will take it into consideration while he will be calculating your rate.

Finally, if your medical tests are really bad and you have no hope to get the policy, try to find the insurance company, that doesn’t demand medical tests. In fact, these companies really exist and they are situated on the whole territory of USA. Nevertheless, when the insurance agent tells you that medical tests are not necessary, be ready that the rate will be high.

The only thing you have to do – is just to compare. If some companies, where you have passed medical tests, offer you really very high rates, consult, what the rates will be if you choose the company without medical exams.

Finally, the terms of the deal may be very flexible. Some companies offer higher rates during the first two years and later the premiums are reduced. The others will reduce the rates, if during a certain period of time your health conditions remain at least not worse or even better than it was earlier.

In any case, remember, that negotiations are necessary. Insurance agents are just people and they can be convinced. Tell about your good habits, prove that you care about yourself and get the policy you like – you are worth it!