Buying a motorcycle often goes in one hand with getting insurance as it is compulsory in USA. But if you have no wish to give even a penny for an insurance policy, I must mention, that you are wrong. For riders getting insurance is as necessary as having a bath at weekend. The statistics defines existing risks for motorcycle owners. And this information is very impressive and sad. We show you the results of a research. The results are prepared by Insurance Institute for highway Safety. It is situated in USA.

In fact, 44% of accidents on the road are made by riders. And it happens even without participation of the second vehicle. Very often a rider can be killed on the road just because his vehicle was thrown out on a roadside. Quite a great quantity of accidents with a deadly outcome happen because riders are not protected so carefully as car drivers. Besides very often they are not so prudent and drunk alcohol before their ride. That’s why insurance policy of this kind is not just obligatory; it is very useful to its owner.

Some clients are not against of insuring the vehicle. But the monthly amount we must pay frightens us. That’s why potential clients ask usually, “What is the average price of motorcycle insurance?”

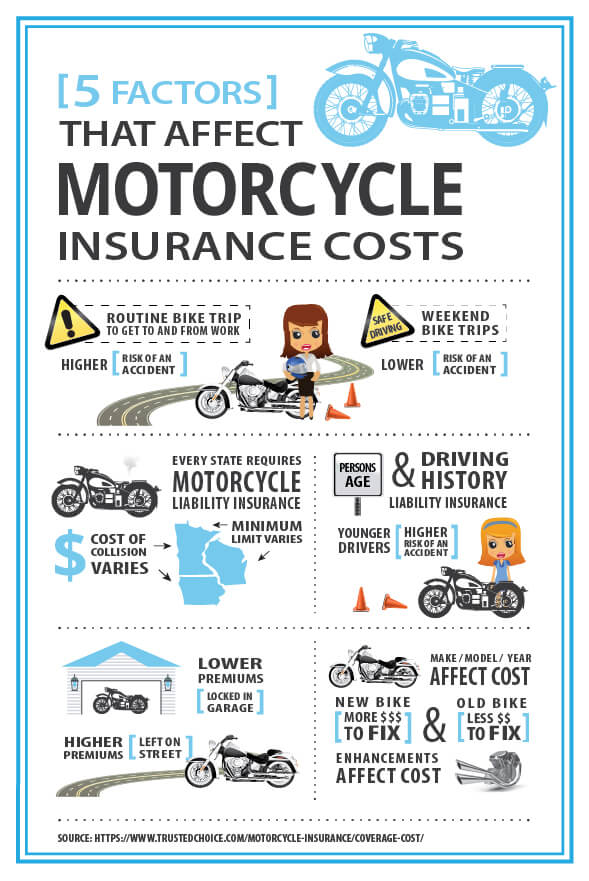

Prices for insurance service are determined by the probability of an accident, or other base probability of loss (like theft or vandalism). So as a rule, tariffs for insurance of motor-equipment are 50%-70% higher, than the average price for auto insurance. The amount of an average monthly payment is calculated individually. It depends on such important facts as:

- Type of the vehicle. More powered motorcycles cost a lot, that’s why they are more expensive to insure.

- The personal information about a rider. If you have great driving history, it you have never got penal coupons and were never noticed drunk while being on the road, then you have a chance to buy insurance policy for more democratic price. In fact your riding experience is also very important for the insurance company. If it is your first vehicle and you are under 22, then you will pay more. It is considered more risky for a company to deal with an inexperienced rider.

- The coverage that you want to receive in case of an accident or other loss. There are a lot of situations when your iron friend remains unprotected and it is not only an accident. Theft, or damage, caused by third parties or natural cataclysms, or even vandalism – all these events can happen and you are able to insure your motorcycle from all these factors. But there’s also some minimal coverage that you will get in any case – usually it is not enough but costs much cheaper.

In fact a motorcycle owner must pay from $100 to 400 dollars per month to protect his vehicle. But it is only the price of liability. In case of collision you won’t get coverage if you get only liability as an insurance quote. So it is recommended to buy the insurance policy that will cost not much and include the necessary quotes at the same time. To find the best average insurance price, let’s compare different types of motorcycle insurance.

Motorcycle Insurance Compare

There’s a variety of insurance companies and the level of their prices varies. First of all the motorcycle owner has to spend several hours in front of his computer screen and simply compare the price lists. For the lazy bones, who don’t want to spend the whole weekend making motorcycle insurance compare, there’s another idea – they can find an agent. Independent insurance agents know the costs of many different companies and for sure they will find that very level of prices you are looking for.

I am sure, you won’t be surprised, if I tell you, that the personality of a rider is also important. Different people will get different rates. Thus young drivers will pay more than mature bikers. Careful drivers will pay less than desperate racers with a set of penalties. The owners of new and expensive vehicles will pay twice more per month than those, who got a cheaper bike. And finally, the riders, who spend the most part of their life on the wheels, will pay less than so called “weekend drivers”.

Usually the average rate per month is calculated individually.

Average Motorcycle Insurance Rates

I know that every reader is waiting for some concrete average motorcycle insurance rates. For sure you won’t pay less than $20 per month in any case – even if you’ve bought the cheapest bike and you are not a rider, but an angel. For those, who are not so innocent or who have expensive solid vehicle, the price will be $300 -$400 per month and more. To find out the amount you have to pay, you can use a calculator (very often insurance companies offer this service online) or consult your agent. In fact you can claim for a discount – from time to time any company offer some discount programs for their clients. Finally you can pay the whole insurance bill at once – usually it costs less than paying some small part of it monthly. You have to remember that knowing all the details of your insurance deal will help you to save money, so be persistent enough in studying this subject. Don’t hesitate to ask your more experienced friends or independent insurance agents in order to get the cheapest motorcycle insurance.

Who Has the Cheapest Motorcycle Insurance?

I think motorcycle owners are deeply interested in this question. First of all try to understand that “the cheapest” is not always “the best”. In order to save some extra dollars, you can forget about the most important safety rules and be very destroyed in case of an accident or theft. On the other hand, quirky insurance agents always try to convince us to get some extra services which are of no use to us. So, who has the cheapest motorcycle insurance? You should be a person with an excellent driving record, with some positive driving experience. Besides you should be a careful person, who uses his vehicle correctly, cares about its serviceability and follows traffic regulations. If you follow the rules of the insurance contract, for sure, you won’t get any penalty and thus will pay less.

In fact any of us think that all the accidents happen to some other, not to us or our relatives. But sometimes everyone has some “black stripe” and no one is insured from the disasters of life. At least we can insure our motorbike from them and get a solid compensation.