Home is my fortress, my lonely island among vicissitudes of life. I feel safe when I am at home. But can we be really sure that our house is protected?

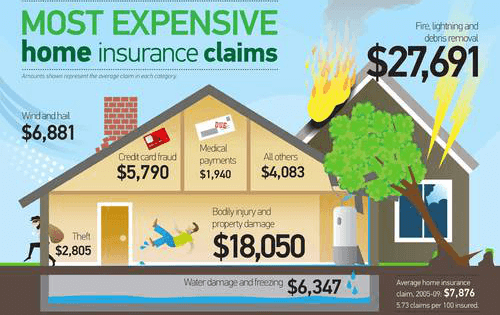

In fact home is not just the source of positive feeling. It is also a source of worries and anxiety. Every minute our house is in danger and some trouble can happen to it. Whether it is a break of a pipe or a flood, storms, thieves or fire – in any case our native home can be damaged or even destroyed. Unfortunately we can’t protect our house from everything, but we can get at least compensation of damage after disaster. Of course we speak about insurance –actually, best home insurance.

Do you have a house or an apartment? The ways of insuring them are different. Insurance of houses and apartments can be divided into three groups. The first one is constructive elements, the second one is finishing of the house (internal and external) and the third one is property (electronics, furniture, an interior, etc.). The client can insure any category of his home separately or in a complex. How can we find the best home owners insurance quotes?

Homeowners Insurance Quotes

A typical homeowner dreams to protect his residence from everything. It is possible, but not so cheap. For those who want to protect their houses and save some money at the same time, it is recommended to find suitable homeowners insurance quotes. The quotes which you choose will influence your rate.

There are some popular quotes that are chosen almost by every homeowner. Thus people usually want to protect their home from floods, war or insects. If you live in an apartment, you should insure your home from the damage your neighbors can cause you (like filling the house with water when the pipe was broken). If you leave in the area that is full of disasters, for sure it is necessary to choose the proper quote. Thus in case of natural disaster you will be paid some compensation to rebuild your house or a part of it.

Fire is another popular quote that is chosen by homeowners in USA. Here are some peculiarities you should know. In this case the material your house is made of is very important. If the walls of your home are made of bricks it won’t be hurt by fire as deeply as it is in case of wooden walls. Thus insurance company will take much more from you to guarantee payments in case of fire if your house is made of wood. If you hire an agent, he will help you to choose the quotes in your particular case.

Instant Home Insurance Quotes

For people who own several houses or apartments it is desirable to insure all of them. If you don’t live in your house or went abroad for a long time – you should take a special care about it. It is twice more necessary to insure instant home because you are not here and that’s why can’t protect it as it is necessary. Of course there are instant home insurance quotes for the clients who don’t live in their houses but still want to keep them safe and new.

How can the house be damaged if I don’t use it? How can it be ruined if no one turns on the water or switches on the light every evening? In fact houses and apartments don’t remain safe without a user for a long time and still can be damaged. There are such threats like fire, arsons or vandalism. Besides capricious nature can play its harmful role. And oops – one day you return to your instant home and find it destroyed or damaged. What to do to prevent it? The answer is simple – just insure your house and find instant home insurance quotes. What quotes are the most popular? Fire and floods take the first place.

Of course it will be better to protect your instant home from nature disasters too. Snowfalls in winter, spring rains, falling of trees in case of hurricane or heavy snow – in any of these cases you can insure your home and get some compensation for it.

Home Insurance Rate

Even if you understand properly that getting home insurance is a good idea, still you may hesitate. What is the reason? Rates, of course. We want to insure our property but we don’t want to pay a lot. How can we find best home insurance rate? The shortest way is to find the information on the topic online. Just take some extra hours studying the insurance companies and the service they offer. You may be lost among plenty of quotes – in this case an agent can help you. And don’t hesitate to ask your friends or relatives who have already insured their property – they may give your precious pieces of advice.

What influences your rate? For sure, the more expensive house or apartment you have, the higher rate will be. If you have precious things inside (like pictures or utensils or some jewelry) then your rate will be increased. As it was mentioned above, the material your house is made of is also important. How many people live in your house? How many members of your family use it every day? What can you tell about the area it is situated? Are hurricanes or tornadoes typical in that area? Representatives of insurance companies will ask you all these questions and probably some other questions too. Your answers will help to form the monthly rate for your home.

Home Coverage Insurance

Imagine that you have already insured your home. You have passed through all those questions, consultations and debates and finally you get your policy. Can you sleep well at night? I am sorry, but you can’t. You can’t, till you know your home coverage insurance.

In fact even if your home is insured, you won’t take compensation even in case of damage if that kind of quote is not mentioned in your policy. So it is necessary to any homeowner in USA to understand well, what is covered in case of damage and what is not covered.

Many clients order additional options to protect their homes in some special cases. Thus some parts of your house may be ruined by damage or simply become too old. Electrical wiring, water supply system or ventilation system can be mentioned in your policy as a quote. So you will get payouts in case of its damage.

In fact there are a lot of options that can be discussed with your agent while insuring your home. A homeowner should think about everything – his favorite things in the house, clothes or awards. He can get coverage for hiring a new apartment where he would live when his house will be repaired. In fact home coverage insurance can help anyone to live a better life if he takes care and chooses the necessary quotes.