What is

the best cat insurance

? Of course, it is the insurance that is affordable to most of people with an average income.

Besides it is the insurance, that covers the most widespread health problems, that cats meet during their life. Cats are special. They are independent, active and not trainable. These peculiarities should be taken into account to find the best insurance for them.

The Best Cat Insurance

Cats are different from all the other animals. They have the following peculiarities, which cause different insured events.

- Independence. This peculiarity causes the loss of the pet. Cats go anywhere they want and whenever they want. Thus you can lose the pet easily.

- Incredible curiosity. It means that your cat will explore your house thoroughly with all your electrical wires, swimming pools, full of water and fireplaces. It can easy cause an accident. Besides cats eat unusual things like needles and buttons very often.

-

They are very fast – much faster, than other domestic animals and climb too high! And they fall quite often too, so traumas and injuries are widespread health problems cats face to.

So, the best insurance for cats mandatory must include coverage for injuries, unexpected illnesses and coverage in case of cat’s loss. Very often insurance companies offer micro chipping of the animal in order to find it in case of its disappearance.

Then a cat, like any other pet, can get hereditary illnesses, respiratory illnesses, can get some unexpected disease. It is desirable to include these points in your cat insurance policy too. Finally, every pet – and a cat is not exclusion – needs preventive care, like regular visits to the vet, dental care, vaccination etc. It is good, if you include these kinds of service in your policy too. To sum up, the best cat insurance must include:

- Emergency coverage

- Hospital care

- Preventive care

- Coverage for medications

- Coverage for home vet visits

- Coverage in case of death of the cat

-

Chipping of the cat

Price is important too, so you should think the problem off and find out, what options you can exclude from this list to reduce the bills. Be always ready to negotiate! Discuss the problems with the agent. If you think both, you will find the best insurance for your pet for a reasonable cost.

What is the average cat insurance cost ? Of course, even the most responsible cat owners have many bills to pay and to add the great amount of premiums for the pet seems too much for them.

It is very hard to answer this question, because there are hundreds of policies and many additional options that you can add to them, so cat insurance cost depends on the insurance plan you choose.

The health condition of the cat and its age are also important factors, which will influence the price of the policy. The young and active species get ill not so often, but elder pets will need the medical care more probably.

Then it is important, what kinds of payments you prefer. The clients, which pay annually for the insurance policy as usual, pay less than those, who like to make monthly premiums.

In average the cost of basic cat insurance policy per month is from $15 to $18 dollars. But basic insurance coverage usually is not enough to guard your pet as it presumes a small amount of coverage for the most wide spread insurance events only. So, it is necessary to study cat insurance plans before you make the final decision.

Cat Insurance Plans

There are hundreds of cat insurance plans and it is very important for a newfound cat owner to find the most profitable among them. The leading pet insurance companies try their best and offer the great variety of services and options, so it is very hard to get the necessary minimum of coverage and not to overpay for the options you don’t need. So be attentive and learn all the details of

cat insurance plans

.

Many insurance companies include the following options in their insurance plans for cats:

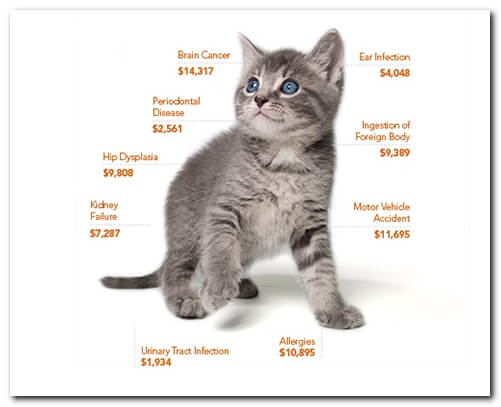

- Coverage for unexpected illness or injury, like diabetes, respiratory illnesses, cancer.

- Most of insurance companies exclude coverage of pre-existing conditions in their insurance plans. Thus, if your cat has already got the symptoms of some illness before you’ve got the policy, this illness won’t be covered.

- Some pet insurance companies exclude payments for inherent illnesses, and others can include them so check this option carefully before you will get the policy.

- Pet insurance companies as usual don’t include preventive care in their policies. So if your cat demands vaccination, regular dental care or regular visits to the vet, you will pay for them from your own pocket. But there are companies, which will offer you the preventive care policy for $200 per month.

-

Pay attention to such thing as a deductible. So, if your deductible is $50, this amount will be excluded from the check that you will get from your insurance company. Pay attention to the deductible, when you choose pet insurance plans.

Every insurance company offers at least four kinds of insurance plans.

- Lifetime

This cat insurance plan presumes paying some annual amount of premium in any case – whether you visit a vet or not. This insurance plan is good for cats with some chronic disease – in this case you will visit your vet’s office regularly.

- Accidental Only

This type of coverage is paid only in case of unexpected trauma or injury.

- Time Limited

It is the insurance plan, which is valid during 12 months only. During this period you can get the coverage and after that time limit it is not paid.

- Maximum Benefit

This policy presumes the maximum amount of payments for some insured event, but it is done only once and then this kind of disease is considered as pre-existing and is not paid. Thus, if your cat has diabetes, for once you will get the coverage from your insurance company, and then the care about your pet is covered by you.

As you see, there’s a great variety of insurance deals that you can make, so take your time to study all the conditions and choose the best cat insurance plan.

If the amount of payments for different cat insurance plans impressed you deeply and you dream to get cheap cat insurance , you should keep in mind the following tips.

First of all, you must know that even if you are extremely lack of money, the necessary options must be included in your policy – otherwise you’d better stay without it.

Then you should pay attention not only to the amount of monthly premiums, but also to the amount of the deductible, as it influences the general cost of the insurance.

Finally, you can apply for the discount at your insurance company, if you get the policies for two and more pets.

But remember that cheap product very often presumes low quality.

To sum up, cats have some peculiarities and you should take them into consideration, when you get the insurance policy. There are different kinds of insurance plans, and it is not easy to find the best one. But if you get the cat, you should care about it and sometimes the price of that care becomes too high. So getting cat insurance is the best way out for a cat owner!