Although the notion “marine insurance” is rather connected with business than with the private boat owner, it can be compared with the expensive hotel with the option “all inclusive”.

If you get this kind of insurance product, you protect your vessel from everything. Thus the vehicle itself is protected from damage, the cargo on its board is protected from loss and boat owner is protected from injury that can be done to any sailor there.

Very often marine insurance is bought for ships that carry cargoes from one country to another. It is very difficult to insure such a vessel, because the laws and insurance terms are very hard to define, when we deal with different nations. So marine insurance is a very wide notion and many kinds of insurance deals are called “marine insurance”.

Does this Insurance Have Time Limits?

Marine insurance is usually taken for a certain period of time. Thus, the vessel, people on its board and the cargo it carries can be insured during their travel from one point to another. Sometimes the whole trip is underinsured (it means, that it is covered up to its return to the dock). If the time limit is over, but the vessel is still not back, the valid period of the deal can be extended, but this option is not free.

But sometimes the owner of the ship can’t predict when the voyage will be over. It is very hard for him to define the time limit of the insurance deal. Especially for such cases the voyage policies are sold. These policies have no time limits and that’s why they are valid till the boat will return back to the place of destination. It doesn’t matter, if it takes a month, several months or a year – it is insured in any case.

Marine insurance can have different time limits. It can have different types as well.

What is Inland Marine Insurance?

First of all it should be mentioned, that inland marine insurance is the kind property insurance. It protects the property that is located on the board. But ships usually travel from one country to another. Every country and every state has some peculiarities as for insurance products. So, it is very hard to define, how exactly the insurance policy works. In this case inland marine insurance is used. It works, when the ship is not affixed yet to any country. If during its trip between two various countries the ship is damaged, it is protected by inland insurance.

What is International Marine Insurance?

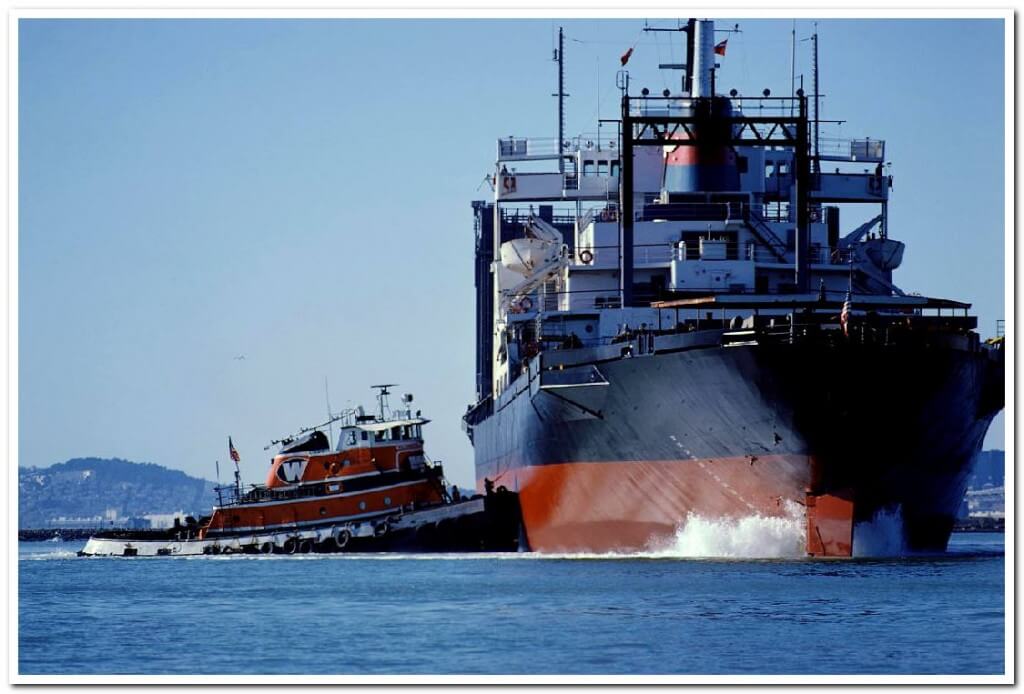

As it was told, very often ships move from one country to another. So they stay some part of their trip in domestic waters and the other part of it in foreign waters. If any accident happens in the foreign waters, the laws of the country, that is native to the ship, don’t work.

The ship owners get international marine insurance to protect their vessels in both, domestic and foreign waters. This kind of policy guarantees protection for the damage of the vessel, for the damage or loss of cargo and for the third party that can be injured during the trip.

What is Global Marine Insurance?

It is the insurance that is bought for both, the boat and its community. It is supposed for extra insurance services that are not covered by standard policy. Every boat is unique and every crew has their own needs and demands. Global marine insurance is the best choice for them. International travelling is interesting, but sometimes it is very hard to protect all the members of the crew and the cargo.

Marine Insurance Coverage

It is a pity, but sometimes insured events can take place. So, this rainy day has become and your ship was ruined – it was crashed by another ship, or it was flooded or the cargo was put on fire. You are the happy owner of marine insurance policy, so you feel free and calm and don’t count the amount of financial loss as you are sure, you are protected. In fact, you can stay calm in this situation only in case, you have studied all the details of the insurance deal. So, what is covered and what is not covered by marine insurance?

As any other insurance, it has its limitations, its special terms and the options, that you have included or excluded from the insurance list.

If you have bought “all risky marine insurance”, just get relax. In any case you will be covered and the amount of coverage will be high enough. But “all risks included” kind of policy has high premiums, that’s why ship owners get it not so often.

Sometimes the owners of the ships are eager to save money, so they don’t get one marine insurance policy, but insure the ship separately – they get hull insurance policy and cargo insurance policy.

Hull insurance policy guarantees the boat owner the coverage for any kind of damage that was done to the boat. If the vessel was hurt by the snag, or if it was clashed by another boat or was set on fire, the owner of the boat can apply for compensation from his insurance company, but for the vehicle only. The cargo on the boat is not covered with hull insurance.

The cargo insurance policy, on the contrary, protects the equipment on the board only. If you plan to get this kind of policy separately, make sure, that the equipment you have can be covered by your insurance company. For example, cars and other vehicles can’t be included to cargo insurance policy. They must be insured separately.

Marine liability insurance is not a question of the owners’ will, it is mandatory. This policy protects the third party that can be wounded during the trip of the ship. It deals with the crew on the ship and it protects the passengers of the other boat if collision takes place.

As you see, there are different kinds of marine insurance deals. It is better to get global marine insurance or international marine insurance that will guarantee safety to the cargo, the crew and the ship in any country they go during the whole period of the voyage. But this kind of policy is not cheap, and that’s why the ship owners try to save money and get many separate insurance policies. It is also possible and recommended, but this kind of a deal is not an easy one, so it must be planned and discussed with the insurance agent in advance.

So, marine insurance policies are widespread nowadays. Protection of ships was the first kinds of insurance deals in the world. Till now shipping remains dangerous, that’s why some extra insurance protection will be on purpose for both, the vessel and its crew!